Elley Martin, Chair of Will to Give and Individual Giving Manager of NI Chest, Heart & Stroke explains the difference gifts in Wills make to local charities and the role Professional Advisors can play.

Why is it so important people leave gifts to charity in their Will?

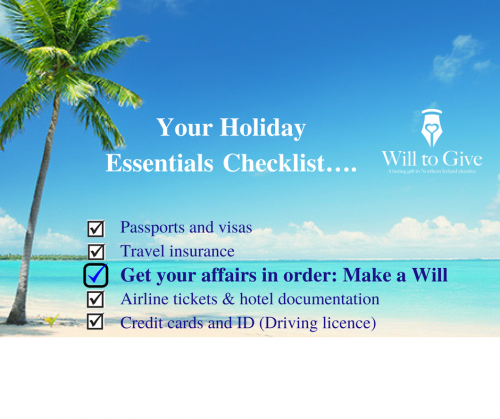

Well firstly I would say it is absolutely crucial for people to simply make a Will. Making a Will ensures loved ones are provided for as you intend and your wishes are respected. If you die without a Will, sorting out your affairs can be very complicated. Recent research undertaken by Legacy Foresight showed that 74% of those surveyed in NI did not have a Will in place!

Secondly gifts in Wills are vitally important to our work and the services we provide. They equate to £2.8 billion per year in the UK to all charities. This income helps provide a vast range of services by our much loved charities. In fact for some charities legacy income is more than half of its fundraised income. The reality is a significant amount of the good work charities deliver would simply not be possible without gifts in Wills.

What lasting difference do gifts in Wills make to NI Chest Heart & Stroke?

A gift in your Will to NICHS could not only help our loved ones, but leave a legacy of hope for generations to come. In NI almost half of all adult deaths are caused by chest, heart and stroke illnesses. NICHS are working to transform the lives of people affected by these devastating health conditions every day. Here in NI we provide life-changing care through our activity groups, self management programmes and family support home visits, as well as funding life-saving research.

Although, diseases of the circulatory system for example, have almost halved over the past 30 years, there are still lives to be saved. A gift to us in your Will could be invested in critical local research that will change the future for families at risk from our biggest killers. The smallest investment could lead to the biggest breakthrough.

Do NI Chest Heart & Stroke rely on charitable gifts in Wills?

Legacy gifts have continued to be the cornerstone of NICHS’s fundraising, making up 56.5% of all donations 2016-17. An incredible £1.967M was bequeathed by 60 people who so generously remembered those affected by chest, heart and stroke illnesses through gifts in their Wills. These funds make possible a huge proportion of our activity and funded our care services and half of our health promotion work throughout 2016-17. Without gifts in Wills, we couldn’t help one in three of the people who need us.

What do NI Chest Heart & Stroke and WTG’s 56 strong charity members do to promote the importance of making a Will and leaving a gift to charity?

It is fair to say that WTG members undertake a varied and busy programme of activity – including a year round social media and PR campaign, awareness raising events including our annual WTG Awareness Week launched in 2016 and a robust series of training for all charities across NI.

We want to ensure our message reaches as many people as possible. After all a legacy is a very special way to support a charity close to your heart. You don’t have to be wealthy or influential to leave one and make a lasting difference.

The Will Notification System developed in conjunction with Sector Matters continues to run smoothly and is of huge benefit for forward planning for charities.

What role can Professional Advisors play in promoting gifts in Wills?

All we ask of our Professional Advisors is that you give your clients the full picture, making them aware that giving to charity in their Will is an option. Again, recent research undertaken by Legacy Foresight indicates that 44% of people in NI are ‘open’ to the idea of leaving a charitable Will gift.

We hope that you will, when it is appropriate to ask and provision for friends and family has been made; ‘Have you considered leaving a gift to a charity in your Will?’

We often find that people think about leaving a charitable gift in their Will when they or their loved ones have been touched by a particular charity’s work or they feel they don’t have anyone to leave their assets to.

The reality is that here in Northern Ireland only 4% of people who write their will leave a charitable gift. This compares to 7% in England and Wales.

Research from Remember a Charity shows that when professional advisors mention that leaving a gift to charity was an option, the percentage of clients who do so increases from 5 to 10%. Furthermore when clients are asked if there were any charities they were passionate about, gifts rise again to 15%.

As a nation, we are extremely generous when it comes to supporting good causes; in fact over 85% give regularly to causes close to hearts. The reality is many people simply won’t have thought of leaving a gift in their Wills, others might not have known it was possible or thought that it was only the very rich that left legacies, while some will say; “I was never asked.”

A second piece of research undertaken by social purpose company The Behavioural Insights Team and the University of Bristol, commissioned by Remember a Charity found:

Discussing charitable legacies in the context of Will-making and in face-to-face meetings is seen as highly appropriate. In an online survey, 46% of respondents said that solicitors have a duty to ask clients about legacy giving, while most respondents were supportive of solicitors asking about charitable giving in Wills.

People writing their Wills for the first time, who heard that others had given, went on to donate roughly 40% more than those who did not receive this information

That’s why Professional Advisors play such a crucial role!

How do WTG work with Professional Advisors to help promote charitable gifts in Wills?

WTG is delighted to have excellent support from Professional Advisors all across NI. Last year we hosted the very successful event ‘Charitable Giving by Will: 12 top tips for Will Drafters’ led by keynote speaker Sheena Grattan BL at the Law Society NI. We are very grateful for the support of Law Society E-Informer and are pleased that our very own e-newsletter is very well received.

Upcoming activity includes at a series of Law Society talks in November in Newry, Enniskillen & Belfast, a PR Campaign involving up to ten Professional Advisors across NI as part of WTG Week November 2017.

Across all of our materials including our Free Will Making Guide we always encourage people to contact a solicitor/professional Will writer to ensure their Will is valid and all wishes are carried out as preferred.

What would you like to say to Professional Advisors who meet with clients and write Wills?

The work of each of the member charities of WTG is dependent on the generosity of the people of NI and your help in giving guidance in relation to gifts in Wills makes an incredibly significant contribution. On behalf of WTG, I would like to thank you most sincerely for all your hard work and support particularly with regard to gifts in Wills.

If your client does decide to leave a gift to charity, it’s worth checking you have the correct charity name and address and a charity registration number too. WTG’s Choosing your Charity section may be helpful.

We know that legators want to picture the difference that their gifts will make and to know their money will be used well. WTG often feature tangible examples of the difference gifts in Wills make to our member charities on social media and across our publications. It really is well worth following us on Twitter or Facebook!